foreign gift tax reddit

Important Practice Tip If you receive a gift from Taiwan for Example of 600000 and your Dad needed 12 of their friends to each facilitate the transfer of 50000 due to currency restrictions this is still reportable. My dad passed away 15 years ago and left behind a trust fund in the UK for me and my sister.

Here S What You Can Do With Leftover Foreign Currency Sofi

If the gifts or bequests exceed 100000 you must separately identify each gift in excess of 5000.

. The gift tax does not apply to any transfer by gift of intangible property by a nonresident not a citizen of the United States whether or not he was engaged in business in the United States unless the donor is an expatriate and certain other rules apply. 13 February 2008 Gifts made out of NRE and FCNR accounts are free from gift tax in India. Foreign Gifts and Bequests.

The IRS ignores gifts under 15k as of 2018 per year per donor per recipient. Gift of 15000 from A to B and also gift of 15000 from A to. To be considered a foreign gift the recipient must elect to treat the property or money as a gift or bequest and exclude the amount from gross income.

And International Federal State or local. Foreign gift over 100k in a year from foreign persons need to be declared by the recipient on Form 3520. But you will also have to follow FEMA Act.

Person must r eport the Gift on Form 3520. News discussion policy and law relating to any tax - US. T he tax treatment of the assets of foreign nationals living in Japan when receiving an inheritance has come under fire as being harsh and unnecessarily draconian.

A direct gift of US. Form 3520 Foreign TrustGifts. Gift of 30000 from A to B.

5 This value is adjusted annually for inflation. You never have to pay taxes on gifts that are equal to or less than the annual exclusion limit. Foreign gift tax reddit Saturday April 2 2022 Edit.

Undisclosed Gifts from a Foreign Person. There is a 100000 annual allowance per individual person who is the foreign gift giver before Form 3520 is required. If you sell the asset for a gain ie.

As there is limit on Gift to Individual in Foreign Currency. Person a foreign person that the recipient treats as a gift or bequest and excludes from gross income. This is the amount of money that you can give as a gift to one person in any given year without having to pay any gift tax.

The 100000 limit can be breached in aggregate by the receipt of several smaller gifts made by that same person or by related persons totaling more than 100000 intended for any one United States individual. If anyone can help with this or simply point me in the right direction Id be so grateful. Heres the contrasting situations where A and B are US residents and C is a foreign national.

More than the givers cost basis then your cost basis for that sale is equal to the donors basis. This is purely informational is not taxed and does not deplete any allowancesexemptionsexclusions. Person receives a gift from a foreign person.

Tax ramifications on the initial receipt of a gift from a foreign person although usually an IRS Form 3520 is required the lack of reporting of the foreign gift on behalf of the US. Just now CPA - US. Citizen and lives and works in Beijing China.

We finally received some payments from the. If a gift exceeds the annual exclusion amount which is. A foreign gift does not include amounts paid for qualified tuition or medical payments made on behalf of the US.

Gift Tax Limit. Real estate will result in a gift tax owed by the foreign person making the gift. Any Estate and Gift Tax program employee considering any contact or exchange with a foreign tax official must contact EOI for guidance.

If anyone can help with this or simply point me in the right direction Id be so grateful. A is taxed on the amount above the exclusion 15000 for 2021. The gift rate is 40 on the amount transferred above 14000.

100k per year before you are required to report it. Gift tax for gifts made to a US. In order for a foreigner to avoid the US.

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than 100000 during the tax year. I was born in the UK but I live in the US now as a Green Card holder. The rules are different when the US.

Procedural and legal authority for the exchange of information with foreign partners is found primarily within IRM 4601121 Authority - Disclosure Confidentiality and Contacts with Foreign Tax Officials. Gifts to foreign citizens are subject to the same rules governing any gift that a US. The annual exclusion of 15000 can further be increased to 30000 if you and your spouse are both US citizens and elect to split the gift.

Person receives a gift from a foreign person that meets the threshold for filing the US. There isnt even a form to report them if you wanted to. A foreign gift is money or other property received by a US.

Foreign Gift Tax the IRS. Taxpayer from a foreign person. Rather you recognize any capital gains or losses on the asset when you sell it.

Gift tax has been abolished for all types of gifts from the 1st October 1998. Chris is not a US. 13 February 2008 Yes it will be taxable.

So apparently gifts from foreign nationals arent taxed. The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle. Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion applies.

Or does this mean I have to report taxes for the financial gift if individual gift exceeds 100k. So A is taxed on 15000. If you receive crypto as a gift cool receiving the crypto alone is not a taxable event and you dont recognize it as income.

The IRS is experiencing significant and extended delays in processing - everything. Consider if possible having an entity own the real estate before making the gift. When IRS Form 3520 Is Due IRS Form 3520 should generally be filed by the 15th day of the fourth month following the end of the recipients tax year.

Even though there are no US. Citizen or resident alien the gratuitous transfer of the asset must be real legal or implied made by a foreign resident individual estate or trust outside of the geographical limits of the United States while the gifted asset is also located outside its borders. Typically if a foreigner gifts money or.

Reddits home for tax geeks and taxpayers. In general a foreign gift or bequest is any amount received from a person other than a US. So doesnt this create a gift tax loophole.

That is because the foreign person non-resident is not subject to US. Making cash gifts to foreign citizens. Once the 100000 threshold has been surpassed the recipient must separately identify each giftinheritance that is more than 5000.

The annual gift tax exclusion is 15000 for the 2021 tax year and 16000 for 2022. The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021. Does this mean I have to report taxes for the financial gift if total exceeds 100k per year.

The krux of the guidelines up until now has been that in certain scenarios a foreign national could owe tax in Japan even years after having formally left Japan whilst living in a completely different country.

Exchange Rate And Currency Project Math Worksheet Real Life Math 2nd Grade Math Worksheets

รายละเอ ยด ช อ เตาเผาธ ปย อนกล บ ว สด เซราม ค ร ปร าง ภ เขา ส แสดงในร ปภาพ ขนาด L H ประมาณ 7 5 9 5cm ค ณสมบ ต Incense Incense Cones New Ceramics

40 Marketing Ideas For Your Business My Billie Designs Business Infographic Business Basics Business Marketing

Effect Of Climate Change On Us Habitat Of Burmese Python 2000 Vs 2100 Climate Change Effects Climate Change Climates

Imgur Com Map Us Map Cartography

Following Its Us 103 Million Round Auth0 Is Exploring Ways To Accelerate Growth

Got This 113 Year Old Coin As Change When I Went To Buy Some Smokes A Few Days Ago At The Gas Station 1900 Silver Dollar Old Coins Coins Valuable Coins

The Best Source For Gaming Monitor Reviews The Best Gaming Monitor Hq Is Your 1 Gaming Monitor Review Website We Feature All The Best Gaming Mon Pinteres

Calculating Income Tax For Foreign Nationals In India A Primer

Tarot 12 Houses Etsy Numerology Horoscope Spiritual Horoscope Astrology Numerology

International Money Transfer Limit Irs Moneytransfers Com

Pin By Yeeh St3r On Graphic Design Kaws Wallpaper Words Prints Kaws Iphone Wallpaper

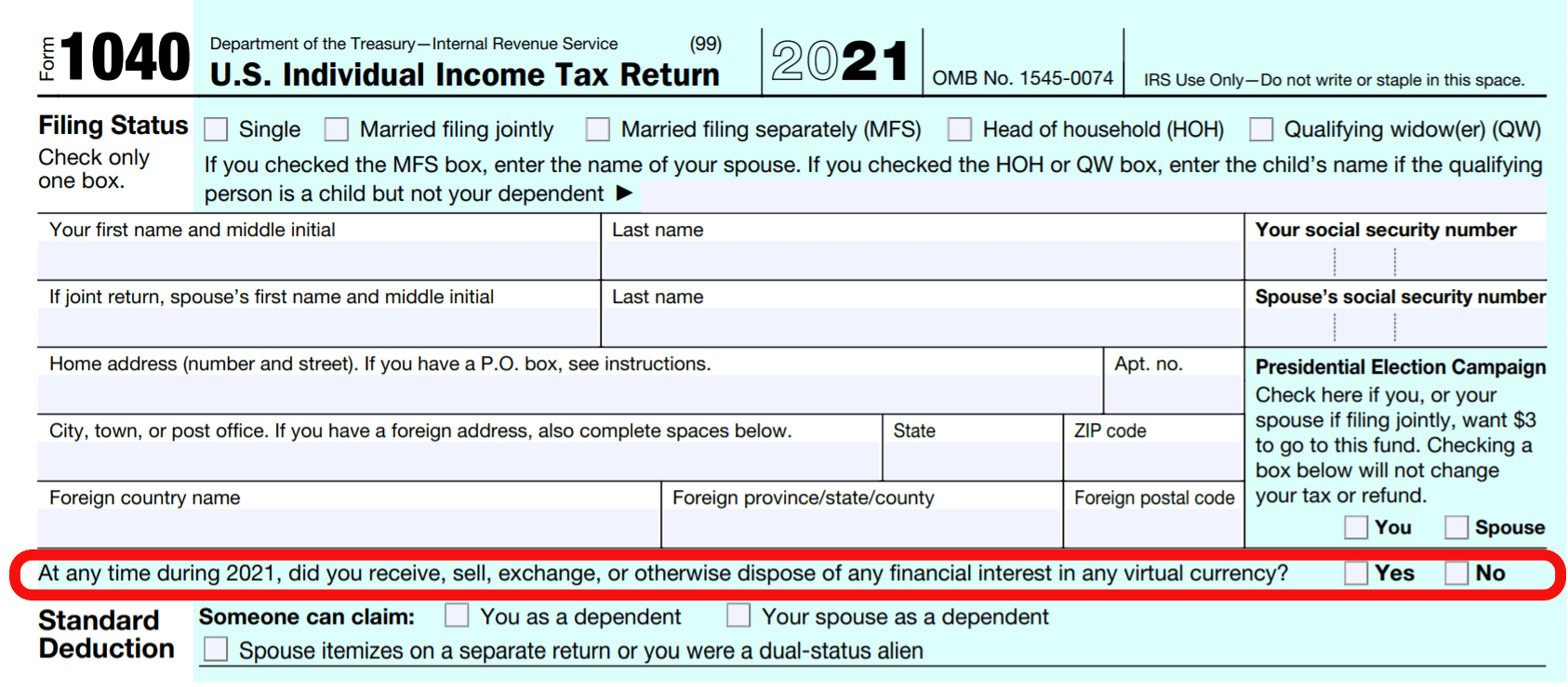

How To Answer The Virtual Currency Question On Your Tax Return

Faqs On New Tcs Rules Applicable To Foreign Remittances R Indiainvestments

Pin By Yeeh St3r On Graphic Design Kaws Wallpaper Words Prints Kaws Iphone Wallpaper

Circulation By Minjae Lee Canvas Print Paintings Art Prints Art Prints Art Painting Oil

World Map According To Colours When I M Thinking Of That Country World Map World Map